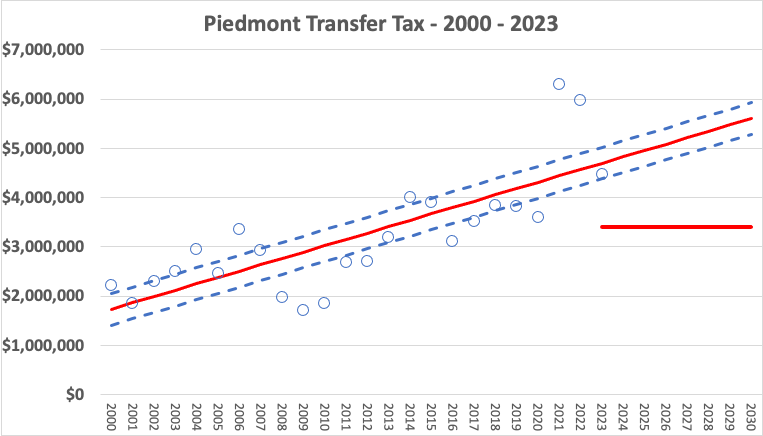

Piedmont’s Real Property Transfer Tax is the tax paid to the City when properties are sold. The circles above are actual revenues, the solid line an estimate of annual revenue until 2030 and the dotted lines the probable range of what these revenues may be – no estimate is perfect. The transfer tax is steadily rising due to Piedmont’s increasing property values. There are occasional hiccups – the 2008 Great Recession and the 2021 COVID “bubble” for example. Other than these two events, the transfer tax has risen consistently over the past 20 years.

The City conservatively estimated that annual transfer tax revenue over this period to be $2.8 and $3.4 annually but actual revenue has exceeded that estimate, substantially in some years. These conservative estimates have resulted in annual surpluses that have city reserve funds at all-time highs, a good thing. However, recent revenue projections by the Budget Advisory and Financial Planning Committee (BAFPC) BAFPC 2023 report assume this flat $3.4 million growth for the next ten years and uses this underestimate to propose increases to the transfer tax and municipal services parcel tax. The BAFPC should update its projections by using the year-to-year rate that can be determined from the 20-year transfer tax growth.

Measure F proponents state that there will be public safety cuts if F fails in March 2024. When? One new dispatcher position is already funded through 2025 and the current parcel tax does not expire until June 2025. So additional public safety services will be in place through 2025. Were F to fail in March, Council will have the option to put a revised measure on the November 2024 ballot or fund an additional dispatcher from the General Fund surplus, currently at 22%.

Measure F is about renewing the municipal services parcel tax and increasing it by 35%. The measure also extends voter approval for the tax from a 4 to 12-year period. Voters can vote to raise the tax now, defeat it now and direct Council to revise its proposal for the November 2024 ballot, or use other surplus funds. None of these options entail service cuts.

YEA Garrett Keating! i’m a piedmonter for 45 years & an economist & the lack of fiscal responsibility in this City has been continuous for the entire 45 years i have been paying taxes.

It started long ago & is maintained by wealthy ‘movers & shakers’ strong influence on elected representives

fiscal responsibility!

STOP F

I’d normally be pretty skeptical of local tax increases. But these aren’t normal times. As we all know Piedmont is surrounded by Oakland. Oakland has the highest crime rates of any large city in California. And it’s rising while most cities are declining. This reality affects Piedmont as well.

I don’t think it’s the right time to be too frugal when it comes to public safety. I urge a Yes vote on Measure F to maintain city services.

It’s not a question of being frugal or the merits of F. Voters just need to understand how parcel tax measures play out in Piedmont. They are always put on the March ballot a year prior to the tax expiring so Council can revise the measure should it lose in March for the November ballot. City services will be maintained under the current tax and additional expenditures until June 2025. Voters should be aware that the parcel tax is just one of several tax increases the BAFPC recommends.

The City Budget Director kindly provided me with exact dollar amounts of the Transfer Tax received the past ten years. In total the City budgeted to receive from Tax Year 2013/2014 to 2022/23 $29M. The actual total received is $42.54M. The City took in $13.54M in excess Transfer Tax or an average of $1.35 additional revenue annually. The median is marginally lower at $1.05 supporting Garret’s data bove that the Transfer Tax is relatively stable.

The last three years the City budgeted for $9.4M and took $16.73M. That is $7.33M additional revenue.

Broadly, in Piedmont, property taxes pay for maintaining the bulk of city services with slight annual increases, the parcel tax pays for new services and the transfer tax pays for capital improvements, though this is not explicit policy. Rick’s message puts a finer point on why some might question the need for more tax from residents – the city woefully underestimates transfer tax revenue. The Piedmont League of Voters has raised a good point – how do the calls from City Hall for more parcel, transfer taxes and bonds affect the tax burden of Piedmonters going forward.