Community members are encouraged to watch or attend Commission and Committee meetings in January to learn about Measure F, a proposed renewal of the City’s longstanding Municipal Services Parcel Tax (“City Services Tax”), which will be on the March 5, 2024 ballot.

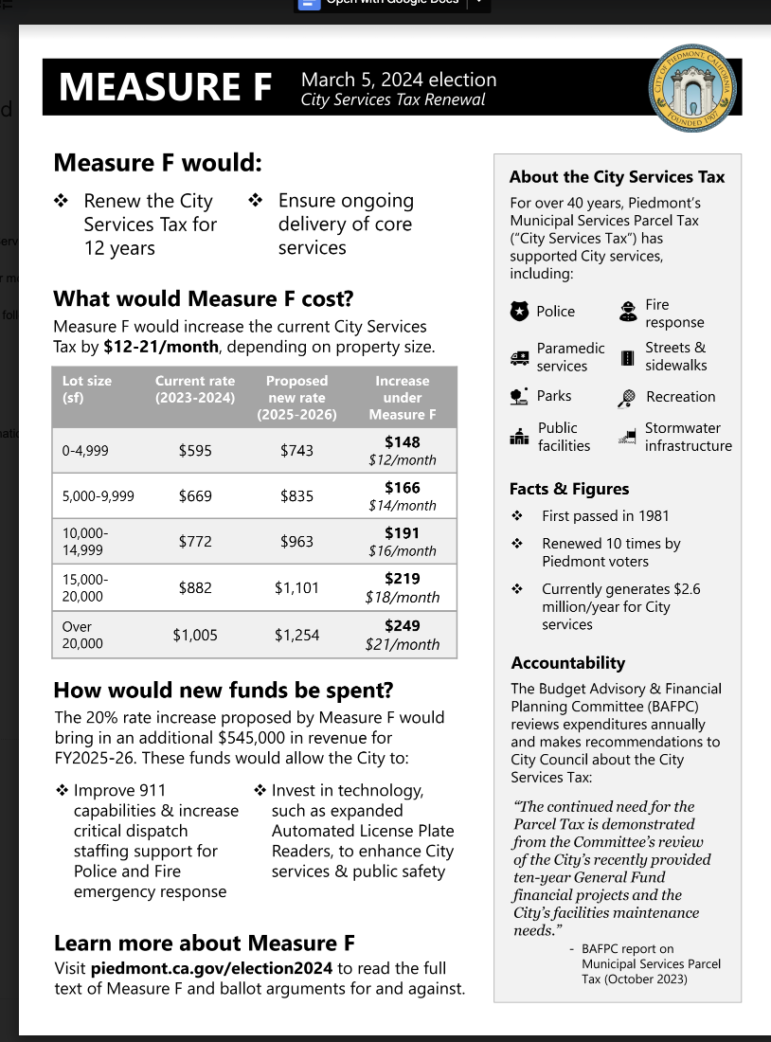

Measure F would renew the City Services Tax for 12 years and raise the assessment by 20% – an increase of $12-21/month for most households.

City Administrator Rosanna Bayon Moore will present an informational report and answer questions about Measure F from Commissioners at the start of the following meetings:

- Recreation Commission: Wednesday, January 17, 7:30pm

- Public Safety Committee: Thursday, January 25, 5:30pm

- Planning Commission: Monday, January 29, 5:30pm

The presentation covers:

- History of the City Services Tax

- Analysis and recommendations from the City’s Budget Advisory & Financial Planning Committee

- How the City uses revenue generated by the tax

Community members in attendance will have an opportunity to speak once on the report after the presentation and before the Commission discussion.

All meetings are held in City Council Chambers at Piedmont City Hall, 120 Vista Avenue.

Meetings of the Park, Planning, and Recreation Commissions can also be viewed online on the City’s website or on KCOM-TV, Comcast Channel 27 and AT&T U-verse Channel 99.

City Services Tax renewal recommended by Budget Advisory & Financial Planning Committee

If it is not renewed, the City Services Tax, which has provided funding for core services such as police, fire, parks, streets, and sidewalks for more than 40 years, will expire on June 30, 2025. The City Council placed a renewal of the City Services Tax on the March 5, 2024 ballot at the recommendation of the Budget Advisory & Financial Planning Committee – a body of resident volunteers appointed by the City Council and charged with reviewing the City’s annual budget, financial projections and long term obligations, as well as examining and making

recommendations on the need for and rate of the City Services Tax.

In their October 2023 report to City Council on the City Services Tax, the Committee recommended that the City Council:

- Continue the City Services Tax “to fund the City’s operating expenses and maintain the quality services which its residents expect;”

- Secure a source of additional revenue, either by increasing the City Services Tax rate or supplementing it through other sources;

- Extend the term of the City Services Tax, which has traditionally been renewed every 4 years, in order to allow for longer-term planning and to ensure predictable funding for existing and future operational and maintenance needs.

More information available online

Community members can find a wealth of detailed information about Measure F on the City’s website at piedmont.ca.gov/election2024. This page provides:

- Key documents about Measure F, including the full text of the ballot measure, the City Attorney’s impartial analysis, and ballot arguments in favor and opposed, and FAQs;

- Full report and analysis of the City Services Tax by the Budget Advisory & Financial Planning Committee;

- Agenda reports and meeting video from City Council discussions of the ballot measure on October 16, November 6, and November 20, 2023.